hotel tax calculator illinois

FedRooms provides federal travelers on official business with FTR compliant hotel rooms for transient and extended stays up to 29 days. From August 2019 through January 2022 my average hotel accident settlement was 147500Im talking about hotel negligence cases that I handled by myself.

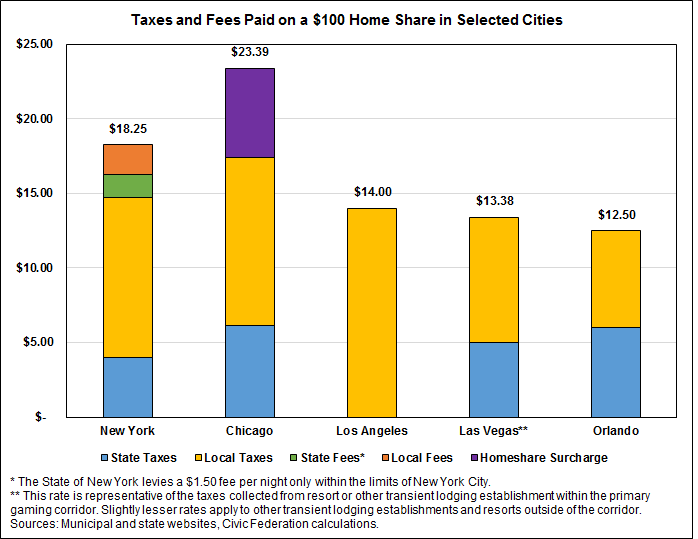

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

We first divided the Median Real-Estate Tax Amount Paid by the Median Home Price in each state.

. We then applied the resulting rates to a house worth. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is. My average hotel injury settlement is so high is because a couple of my settlements were big.

Also called manufactured homes mobile homes used as a dwelling receive a 35 sales tax exemption which means the remaining 65 is taxed at the full sales tax rate. Illinois These occupational employment and wage estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan areas in Illinois. Clarification needed is the person who prepares and files the Certificate of Incorporation with the concerned state.

Share per value refers to the stated minimum value and generally doesnt correspond to the actual share value. Prescription Drugs are exempt from the Idaho sales tax. Per OMB Circular A-123 federal travelers must provide a tax exemption certificate to lodging vendors when applicable to exclude state and local taxes from their hotel bills GSAs SmartPay team maintains the most current state tax information including any applicable forms.

In order to identify the states with the highest and lowest tax rates WalletHub compared the 50 states and the District of Columbia across four types of taxation. These add up to 040 per gallon of beer 076 per gallon of wine and 303 per gallon of distilled spirits. What is my average settlement for recent hotel accident cases.

With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. The program uses FEMA and ADA-compliant rooms with flexible booking terms at or below per. Comprehensive NASCAR news scores standings fantasy games rumors and more.

Idaho has 12 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Unlike tax rates which vary widely based on an individuals circumstances tax burden measures the proportion of total personal income that residents pay toward state and local taxes. Counties and cities can charge an additional local sales tax of up to 31 for a maximum possible combined sales tax of 96.

Louisianas state cigarette tax of 108 per pack of 20 cigarettes. With tools for job search resumes company reviews and more were with you every step of the way. Cigarettes are taxed at 252 per pack in Wisconsin.

The Washington state sales tax rate is 65 and the average WA sales tax after local surtaxes is 889. Wisconsin Cigarette Tax. One simple ratio known as the tax burden helps cut through the confusion.

Washington has 726 special sales tax jurisdictions with local sales taxes in. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. One was a slip and fall and the other was a trip.

Louisiana Cigarette Tax. An alternative sales tax rate of 9375 applies in the tax region San Jose Hotel Business Improvement District Zone B which appertains to zip codes 95110 95112 95126 95131 and 95134. How does the Personal Salary Report help you negotiate salary.

Groceries and prescription drugs are exempt from the Washington sales tax. There are approximately 69219 people living in the San Jose area. In addition to sales taxes alcohol in Louisiana faces additional excise taxes.

Tax Accounting. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. And it isnt uniform across the US either.

Wisconsin Mobile Home Tax. GSA Lodging Programs Shop for lodging at competitive often below-market hotel rates negotiated by the federal government. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

Registered agents are responsible for receiving all legal and tax documentation on behalf of the corporation. This is the 19th-highest cigarette tax in the country. You tell us about you.

Property Tax City Of Decatur Il

States With Highest And Lowest Sales Tax Rates

Setting Up Tax Rates And Adjusting Tax Options

Ohio Sales Tax Small Business Guide Truic

What Are Payroll Taxes And Who Pays Them Tax Foundation

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

The Independent Contractor Tax Rate Breaking It Down Benzinga

Setting Up Tax Rates And Adjusting Tax Options

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Accuratetax Com Sales Tax Automation Solutions For E Commerce Businesses E Commerce Business Tax Software Solutions

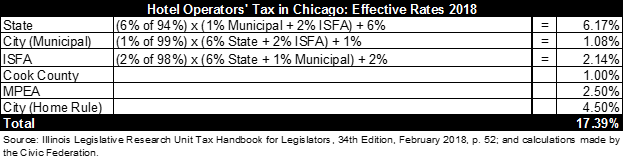

Hotel Operators Occupation Tax Excise Utilities Taxes

Want To Learn How To Organize Your Budget But Not Sure Where To Start I Ll Share 60 Simple Budget Categories To Hel Budget Categories Budgeting Simple Budget

Property Tax City Of Decatur Il

Property Taxes Other Tax Information Yorkville Il Official Website

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)